Table of Contents

1. The Global Logistics Challenge

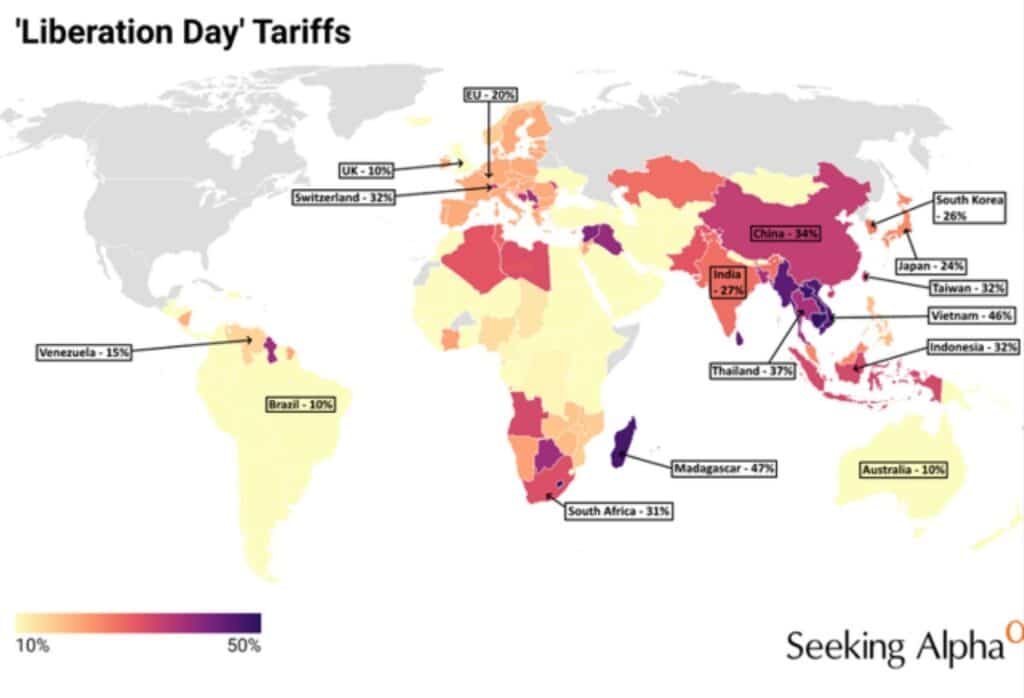

As Trump Tariffs impact Shipping Costs in 2025, the logistics world is bracing for another summer of strategic recalibrations. This is not just a political headline, it’s a direct hit to supply chains across the globe. For companies shipping into or out of the US, or even routing through tariff-impacted countries, the challenges are mounting.

- What are Trump Tariffs impact Shipping Costs? Protectionist trade duties on imported goods, often targeting key global economies such as China, Germany, and Mexico. Initially implemented to reduce trade deficits, these measures have become a recurring policy lever.

- Why do they matter? They lead to increased costs, disrupted routes, and administrative overload. Goods that used to flow freely now face additional documentation, unpredictable border checks, and longer lead times.

- How do they impact logistics? Expect customs bottlenecks, reclassification issues, and forced route changes. Freight forwarders need to act as consultants, not just carriers.

- What’s at stake this summer? With the 2025 summer peak season around the corner, capacity is tight, and shippers need agility. Delays can lead to stockouts, penalties, and broken commitments.

- Strategic takeaway: Businesses that align with logistics partners offering customs control, flexible transport options, and warehousing safety nets will navigate this season best.

For a background on trade protectionism and its impacts, read this World Economic Forum article on trade policy.

2. Logistics in Summer 2025

Summer 2025 is poised to test the resilience of global supply chains like never before. Predictions are stark, but preparation can make the difference.

- Forecast: Up to 30% of global shipments may be cancelled or delayed due to ripple effects from Trump Tariffs impact Shipping Costs. Supply chains already strained by inflation and labor shortages will be further stressed.

- Main causes: Rising fuel prices, inconsistent customs policies, and tariff-based redirection of global traffic. Warehouses may become overburdened, and shipping schedules may shift weekly.

- Corporate reactions: Companies are reducing reliance on single suppliers and increasing nearshoring, relocating production to neighboring or politically aligned countries. Intra-European trade and Mediterranean ports are experiencing more demand.

- Technology adoption: Real-time tracking, AI-based risk assessment, and digital twin logistics simulations are now core tools for planning.

- The new logistics challenge: Logistics providers must offer not just routing but scenario planning. They need to proactively suggest new corridors and buffer options.

For more insights on nearshoring trends, see this McKinsey report on supply chain reconfiguration.

3. Current Comparison Across Three Continents

China:

- Still the epicenter of US trade conflict, especially in electronics, machinery, and consumer goods.

- Billions in goods face increased duties, pushing costs up across global markets.

- Companies are moving production to Vietnam, India, and Eastern Europe, but infrastructure gaps make logistics complex.

- Freight strategies now include third-country routing, which demands greater customs precision and risk management.

- Customs brokers are overwhelmed, and secondary Asian ports are nearing capacity.

Mexico:

- Initially a beneficiary of trade shifts away from China, Mexico is now under new scrutiny.

- Tariffs target NAFTA components, especially in automotive and food sectors.

- Trade volume has increased, but border congestion has worsened. Wait times at US–Mexico ports of entry have doubled in some locations.

- Shippers using Mexico as a hub for US market access must now consider regulatory unpredictability and legal ambiguity.

- Internal warehousing in Mexico has grown as firms seek to buffer delays.

Germany:

- Trump Tariffs impact Shipping Costs target German vehicles, machine tools, and parts, which account for a significant portion of EU exports to the US.

- Exporters face a dual challenge: tariff costs and extended border inspections in US ports.

- This has fueled renewed interest in leveraging EU–Canada and EU–Japan free trade deals to shift flows.

- Air freight between Frankfurt and North America has risen, and warehousing in Dutch and Polish ports is expanding.

- Strategic response includes building customs clearance hubs in less congested areas.

Explore more on EU trade reactions via the European Commission’s Trade Policy page.

4. Most Affected Trade Routes

Knowing where bottlenecks are likely to appear helps companies adapt early. These routes are under the most pressure:

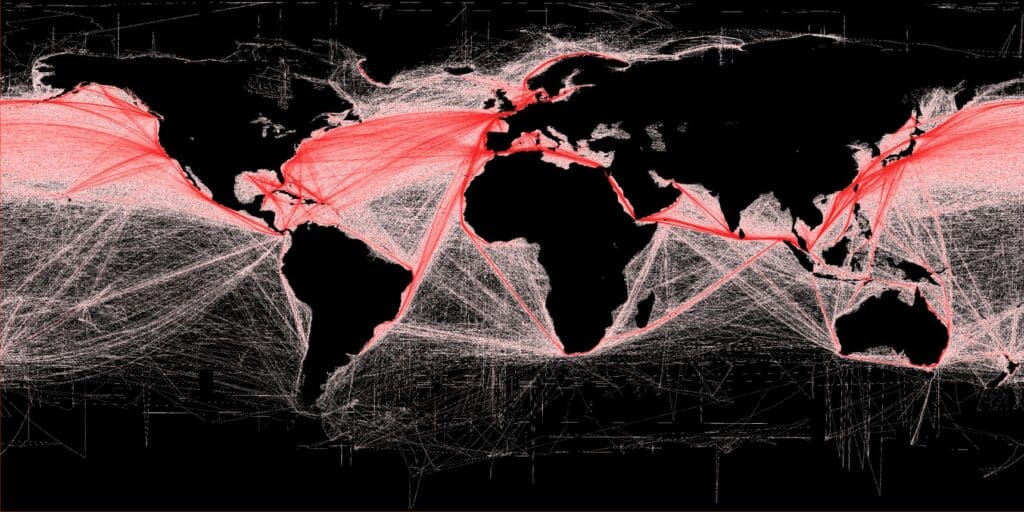

Transpacific Eastbound:

- Traditionally the backbone of global retail imports into the US.

- Subject to high variability in freight rates and service reliability.

- Trump Tariffs impact Shipping Costs have increased demand for indirect shipping routes via Canada or Latin America.

- US West Coast ports remain congested, while East Coast ports report longer inspection times.

- Many retailers are shifting to origin-agnostic sourcing to reduce dependence on this corridor.

NAFTA Corridors:

- Cross-border trucking from Mexico to the US is facing serious slowdowns.

- Laredo and El Paso crossings are under strain, and freight capacity is expensive.

- NAFTA trucking firms are consolidating shipments and using digital customs to speed up flows.

- Shippers are exploring alternatives like rail corridors from Mexico to Canada, bypassing US tariffs.

Transatlantic:

- Air and sea freight between Europe and the US is seeing major cost increases.

- Tariffs impact pharma, auto parts, and aerospace components the most.

- Shippers are using bonded warehouses in Benelux and Ireland to reroute inventory.

- Intermodal shipping via UK or Scandinavia is growing to bypass congested hubs.

- Demand for customs compliance platforms is rising as paperwork complexity increases.

5. Solution for reduced Shipping Costs?

While Trump Tariffs impact Shipping Costs remain unpredictable, freight networks built around flexibility, knowledge, and regional agility are better prepared.

- Integrated networks: When warehousing, customs, and transport are handled in one ecosystem, response time improves.

- Decentralized planning: European hubs (e.g., Benelux, Poland, Portugal) allow rerouting with less lead time.

- Intermodal transport: Combining road, rail, and sea provides more detour options.

- Digital customs management: Booking with companies that give real-time compliance insights.

- Scenario modeling: Smart forwarders are building contingency plans for every lane and tariff possibility.

What’s clear is that logistics success under Trump Tariffs impact Shipping Costs doesn’t come from waiting, it comes from planning and proactive adaptation.

6. Reliable Logistics

At Portex Logistics, we understand the turbulence Trump Tariffs impact Shipping Costs bring to global supply chains, and we’re built to help our clients stay ahead.

- Limited Exposure: Our operations center on EU lanes (Benelux–Spain/Portugal), away from the most volatile tariff zones.

- In-House Customs Clearance: Our team handles all documentation, classification, and compliance internally, no outsourcing delays.

- Strategic Warehousing: Facilities across Spain, Portugal, and the Netherlands allow for agile inventory management.

- Intermodal Transport Expertise: Road, rail, and short-sea options are optimized daily to handle shifting needs.

- Buffer Against Instability: We offer bonded storage, consolidation centers, and flexible load management so your goods keep moving.

If you’re planning your logistics for the 2025 summer season, learn how Portex can protect your margins and your reputation. Visit our Warehousing Services, Transport to Spain, or Transport to Portugal pages to see how we operate.

To avoid delays and cancelled shipments, contact our team